This article delves into the latest trends in inflation within the United States, exploring economic factors, consumer behavior, and expert analyses to provide comprehensive insights into this critical topic.

Inflation is a crucial economic indicator that reflects the rate at which the general level of prices for goods and services rises, subsequently eroding purchasing power. A moderate level of inflation is often seen as a sign of a growing economy, but when it accelerates, it can lead to significant economic challenges. For consumers, rising prices mean that their money buys less than before, impacting their spending habits and overall financial health. Businesses, on the other hand, may face increased costs that can squeeze profit margins, leading to a potential slowdown in hiring and investment.

The latest reports indicate that inflation rates have experienced notable fluctuations. As of recent data, inflation has hovered around 3-5% annually, with certain sectors experiencing even higher rates. For instance, the housing and food sectors have seen significant price increases, largely driven by supply chain disruptions and increased demand post-pandemic. This section will delve into detailed statistics, providing insights on how inflation varies across different commodities and services, helping consumers and businesses alike to navigate the current economic landscape.

The Federal Reserve plays a pivotal role in managing inflation through its monetary policy tools. By adjusting interest rates and employing strategies such as quantitative easing, the Fed aims to maintain price stability and foster economic growth. When inflation rises, the Fed may increase interest rates to cool down the economy, making borrowing more expensive and encouraging saving. This section will explore the effectiveness of these strategies and their implications for the overall economy.

Inflation significantly impacts consumer behavior, leading to changes in spending habits. As prices rise, consumers may prioritize essential goods over luxury items, adjusting their budgets accordingly. This shift can lead to decreased consumer confidence, which in turn affects overall economic growth. Understanding these behavioral changes is crucial for businesses aiming to adapt their marketing strategies. This section will analyze various consumer responses to inflation, providing insights on how companies can better meet their customers’ evolving needs.

Inflation does not affect all sectors uniformly. Industries such as energy, transportation, and healthcare often experience higher inflation rates due to specific supply chain issues and regulatory changes. For example, the energy sector has seen price spikes due to geopolitical tensions and production cuts. This section will dissect how different industries respond to inflationary pressures and what this means for consumers and investors.

Recent global events have highlighted the fragility of supply chains, significantly contributing to rising inflation. Disruptions caused by the pandemic, labor shortages, and logistical challenges have led to increased costs for manufacturers and retailers, which are often passed on to consumers. This section will analyze the specific factors behind these disruptions and their long-term implications for inflation.

U.S. inflation is intricately linked to global economic conditions. Factors such as international trade policies, commodity prices, and geopolitical events can have a profound impact on domestic inflation rates. For instance, fluctuations in oil prices can drive up transportation costs, affecting prices across various sectors. This section will explore how interconnected the global economy is and the implications for U.S. inflation.

Forecasting inflation is a complex task, influenced by numerous variables including economic growth rates, labor market conditions, and fiscal policies. Experts have varying predictions, with some anticipating a gradual decrease in inflation rates while others warn of persistent inflationary pressures. This section will summarize expert analyses and predictions, providing a range of outlooks for consumers and policymakers.

In an inflationary environment, consumers can adopt several strategies to mitigate its effects. Budgeting effectively, prioritizing essential purchases, and considering investment options that historically outpace inflation are crucial steps. This section will provide practical tips and resources for consumers to navigate rising costs and maintain their financial health.

There exists a close relationship between inflation and interest rates. Typically, as inflation rises, interest rates follow suit, impacting borrowing costs for consumers and businesses. This section will explain the dynamics of this relationship and its implications for loans, mortgages, and savings, helping readers understand how to manage their finances in an inflationary climate.

Government interventions play a crucial role in stabilizing inflation. Recent policies aimed at controlling rising prices include fiscal stimulus measures and regulatory changes. This section will evaluate the effectiveness of these policies and their potential long-term impacts on the economy and consumer prices.

Inflation can lead to heightened anxiety and uncertainty among consumers, affecting their spending patterns and overall confidence in the economy. As prices rise, consumers may feel compelled to alter their financial behaviors, leading to a cycle of reduced spending and economic slowdown. This section will explore the psychological dimensions of inflation and its broader implications for consumer sentiment and economic health.

Understanding Inflation: What It Means for the Economy

Inflation is a critical economic indicator that reflects the rate at which the general level of prices for goods and services rises, eroding purchasing power. As prices increase, the value of currency diminishes, which can significantly affect both consumers and businesses. Understanding inflation is essential for making informed financial decisions, as it impacts everything from household budgets to corporate strategies.

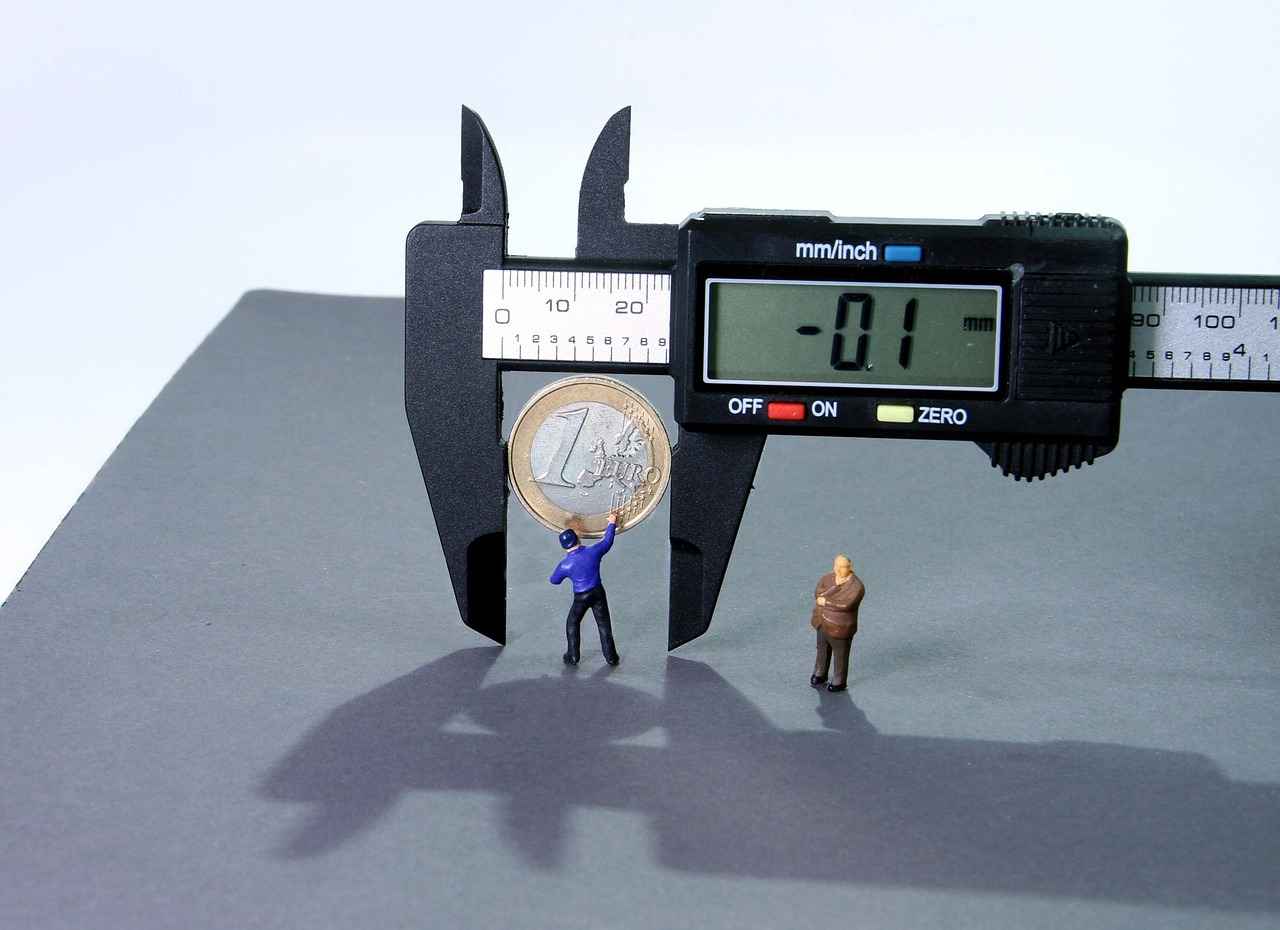

One of the primary implications of inflation is its effect on purchasing power. When inflation rises, consumers find that their money buys less than before. For example, if the inflation rate is 3%, a product that costs $100 today will cost $103 next year. This gradual increase can be particularly challenging for those on fixed incomes, such as retirees, who may struggle to keep up with rising costs.

Moreover, inflation can lead to economic instability. High inflation rates can create uncertainty in the market, making it difficult for businesses to plan for the future. Companies may hesitate to invest in new projects or hire additional staff, fearing that rising costs will eat into their profits. This can lead to slower economic growth and increased unemployment rates.

Understanding inflation also involves recognizing its causes. Factors such as monetary policy, supply chain disruptions, and global economic conditions can all contribute to inflationary trends. For instance, when central banks increase the money supply to stimulate the economy, it can lead to higher inflation if demand outstrips supply. Similarly, disruptions in the supply chain, such as those caused by natural disasters or geopolitical tensions, can lead to shortages and increased prices.

For consumers, understanding inflation is crucial for budgeting and financial planning. With rising prices, individuals may need to adjust their spending habits, prioritizing essential goods and services while cutting back on non-essential items. This shift can also influence consumer confidence, as people may feel less secure about their financial futures during periods of high inflation.

In summary, inflation is more than just a number; it is a significant economic force that affects purchasing power, economic stability, and consumer behavior. By understanding its implications, both consumers and businesses can make better financial decisions and navigate the complexities of the economy more effectively.

Current Inflation Rates: An Overview of Recent Trends

In recent months, the U.S. economy has experienced notable fluctuations in inflation rates across various sectors. These changes have significant implications for both consumers and businesses, influencing everything from purchasing power to investment decisions. Understanding these trends is crucial for navigating the current economic landscape.

According to the latest data from the Bureau of Labor Statistics, the Consumer Price Index (CPI) has shown a year-over-year increase of approximately 4.2%. This figure indicates a persistent inflationary trend, although it is a decrease from the peak of 9.1% observed in mid-2022. The decline suggests that inflation may be stabilizing, yet the current rates still reflect considerable economic pressures.

Sector-Specific Analysis

- Food and Beverage: Prices in this sector have risen significantly, with an increase of 5.6% over the past year. Factors such as supply chain disruptions and increased transportation costs have contributed to these hikes.

- Housing: The housing market continues to face inflationary pressures, with rental prices increasing by 7.5%. This trend is largely driven by a shortage of available housing and rising mortgage rates.

- Energy: Energy costs have seen fluctuations, with gasoline prices experiencing a 10% drop recently, yet overall energy costs remain elevated due to geopolitical tensions and supply challenges.

- Healthcare: The healthcare sector has seen a more modest increase of 3.1%, reflecting ongoing adjustments in medical services and pharmaceutical pricing.

These sector-specific trends highlight the uneven nature of inflation, where some areas experience more pronounced increases than others. For consumers, this means that while some prices may stabilize, others may continue to rise, impacting overall budgeting and spending habits.

Implications for Consumers and Businesses

For consumers, the current inflation rates can lead to a decrease in purchasing power. As prices rise, individuals may find themselves spending a larger portion of their income on essential goods and services. This can result in a shift in consumer behavior, with many opting for budget-friendly alternatives or delaying major purchases.

Businesses, on the other hand, face challenges in managing operational costs. Rising prices for raw materials and labor can squeeze profit margins, compelling companies to make difficult decisions regarding pricing strategies. Some may pass increased costs onto consumers, while others may absorb them to maintain market share.

In conclusion, understanding the recent trends in inflation rates is vital for consumers and businesses alike. By staying informed about sector-specific changes and their implications, individuals and organizations can better navigate the complexities of the current economic environment.

The Role of the Federal Reserve in Controlling Inflation

The Federal Reserve, often referred to as the Fed, is a pivotal institution in the United States that influences the economy through its monetary policy. Understanding the role of the Federal Reserve in controlling inflation is essential for grasping how economic stability is maintained. This section delves into the specific strategies employed by the Fed to manage inflation and their broader impacts on the economy.

One of the primary tools the Federal Reserve utilizes is the manipulation of interest rates. By adjusting the federal funds rate, the rate at which banks lend to each other overnight, the Fed can influence borrowing costs across the economy. When inflation rates rise above the target level, the Fed may decide to increase interest rates. This action typically leads to higher costs for loans, which can reduce consumer spending and business investments, ultimately cooling down inflationary pressures.

In contrast, when inflation is low, the Fed might lower interest rates to encourage borrowing and spending. This strategy aims to stimulate economic growth by making credit more accessible. Such adjustments are crucial as they help to balance the economy, ensuring that inflation remains within a manageable range.

Another significant strategy employed by the Federal Reserve is open market operations. This involves the buying and selling of government securities in the open market. When the Fed purchases securities, it injects liquidity into the banking system, which can lower interest rates and promote spending. Conversely, selling securities can help to absorb excess liquidity, raising interest rates and curbing inflation. This dual approach allows the Fed to respond dynamically to changing economic conditions.

The Federal Reserve also engages in forward guidance, a communication strategy aimed at shaping expectations about future monetary policy. By clearly signaling its intentions regarding interest rates and economic outlook, the Fed can influence consumer and business behavior. If the Fed indicates that it plans to keep interest rates low for an extended period, it can encourage spending and investment, thereby stimulating economic activity. However, if inflation is anticipated to rise, the Fed may signal a tightening of monetary policy, which can have a cooling effect on inflation expectations.

Moreover, the Federal Reserve monitors various economic indicators, including employment rates, consumer spending, and global economic trends, to inform its policy decisions. By analyzing these data points, the Fed can make informed choices that aim to stabilize prices and foster maximum employment. The interplay between inflation and employment is a crucial aspect of the Fed’s dual mandate, which seeks to promote both price stability and full employment.

In summary, the Federal Reserve employs a range of strategies to control inflation, including interest rate adjustments, open market operations, and forward guidance. These tools enable the Fed to respond effectively to economic fluctuations, aiming to maintain a stable economic environment. Understanding these mechanisms is vital for consumers and businesses alike, as they navigate the complexities of an ever-changing economic landscape.

Consumer Behavior: How Inflation Affects Spending Habits

Inflation is a powerful force that can reshape consumer behavior in significant ways. As prices rise, consumers are often compelled to reassess their purchasing habits, leading to a ripple effect throughout the economy. This section delves into how inflation alters spending decisions and influences consumer confidence.

Understanding the Impact of Rising Prices

When inflation occurs, the purchasing power of money decreases, meaning consumers can buy less with the same amount of money. This reality prompts individuals to prioritize their spending, often leading them to cut back on non-essential items. For instance, a family may choose to forgo dining out in favor of cooking at home, or they may delay purchasing a new car until prices stabilize.

Shifts in Consumer Confidence

Inflation can also affect consumer sentiment. As prices increase, consumers may feel uncertain about the future, leading to decreased confidence in their financial situations. This uncertainty can result in a more cautious approach to spending. When consumers anticipate that prices will continue to rise, they may rush to make purchases, fearing that waiting will result in even higher costs. This behavior can create short-term spikes in demand, further complicating the inflationary cycle.

Essential vs. Non-Essential Spending

With inflation at play, consumers often distinguish between essential and non-essential goods. Essentials—such as food, housing, and healthcare—remain a priority, while discretionary spending on luxury items, entertainment, and travel may see a decline. For example, a survey might reveal that while consumers are still buying groceries, they are cutting back on vacations or opting for less expensive entertainment options.

Adapting to Inflation: Strategies for Consumers

- Budgeting Wisely: Consumers are encouraged to create and stick to a budget that accounts for rising prices.

- Seeking Discounts: Utilizing coupons, sales, and loyalty programs can help mitigate the impact of inflation.

- Investing in Quality: Purchasing higher-quality items that last longer can be a more cost-effective strategy in the long run.

Long-term Behavioral Changes

The effects of inflation can lead to lasting changes in consumer behavior. As people become accustomed to higher prices, they may alter their shopping habits permanently. For example, the trend toward online shopping has accelerated during inflationary periods, as consumers seek to compare prices easily and find the best deals. Additionally, the rise of second-hand and thrift shopping has gained popularity as consumers look for ways to save money.

Conclusion

In summary, inflation is a significant factor that influences consumer spending behaviors. As prices rise, consumers adjust their spending habits, often prioritizing essentials and seeking out cost-saving strategies. Understanding these behavioral shifts is crucial for businesses and policymakers alike, as they navigate the complexities of an inflationary economy.

Sector-Specific Inflation: What Industries Are Most Affected?

Inflation manifests differently across various sectors of the economy, influenced by unique supply and demand dynamics, production costs, and consumer behaviors. This section delves into the specific industries that experience inflation most acutely and examines the underlying reasons for these disparities.

1. Energy Sector

The energy sector is often one of the most volatile areas affected by inflation. Fluctuations in oil prices due to geopolitical tensions, natural disasters, or changes in supply and demand can lead to significant price increases. For instance, when crude oil prices rise, the costs of gasoline and heating oil follow suit, impacting both consumers and businesses. The transition to renewable energy sources also plays a role, as initial investments can lead to higher costs before long-term savings are realized.

2. Food Industry

Inflation in the food industry is heavily influenced by agricultural conditions, supply chain disruptions, and labor costs. Poor harvests due to climate change or natural disasters can lead to food shortages, driving prices up. Additionally, rising transportation costs due to fuel price increases further exacerbate food inflation. As consumers face higher grocery bills, they often adjust their purchasing habits, opting for less expensive alternatives.

3. Housing Market

The housing market is another critical area where inflation is felt intensely. Rising construction costs, driven by increased prices for raw materials like lumber and steel, contribute to higher home prices and rents. The demand for housing continues to outpace supply in many urban areas, further driving up prices. This sector’s inflation impacts not only homebuyers but also renters and investors, creating a ripple effect throughout the economy.

4. Healthcare Sector

Healthcare costs have been rising for years, and inflation continues to affect this sector significantly. Factors such as increased demand for services, the high cost of medical equipment, and rising pharmaceutical prices contribute to overall inflation in healthcare. As wages for healthcare workers rise, these costs are often passed on to consumers, leading to higher insurance premiums and out-of-pocket expenses.

5. Transportation and Logistics

The transportation industry has faced considerable inflationary pressures, particularly due to rising fuel prices and supply chain disruptions. Increased shipping costs impact not only consumer goods but also the prices of raw materials for manufacturers. This sector’s inflation is particularly evident in the costs associated with freight and logistics services, which can lead to higher prices for a wide range of products.

6. Technology Sector

While the technology sector has historically seen rapid price declines due to innovation and competition, inflation can still impact it. Increased costs for components, such as semiconductors, have led to higher prices for consumer electronics. Additionally, rising labor costs in tech-driven industries can contribute to inflationary pressures, affecting everything from software development to customer support.

In conclusion, understanding how different sectors experience inflation is crucial for consumers and businesses alike. Each industry faces unique challenges that contribute to its inflationary pressures, from energy and food to healthcare and technology. By recognizing these variations, stakeholders can better navigate the economic landscape and make informed decisions in response to inflationary trends.

The Impact of Supply Chain Disruptions on Inflation

In recent years, supply chain disruptions have emerged as a significant factor contributing to inflationary pressures across the globe. The interconnectedness of global markets means that any hiccup in the supply chain can have a ripple effect, leading to increased costs for consumers and businesses alike. This article delves into the various ways in which supply chain issues are contributing to rising inflation, examining the underlying causes, effects, and potential solutions.

One of the primary reasons for these disruptions is the COVID-19 pandemic, which caused widespread factory shutdowns and labor shortages. As demand surged post-lockdowns, the inability to meet this demand led to shortages of essential goods. For instance, industries such as automotive and electronics faced significant delays due to a lack of semiconductors, resulting in higher prices for consumers.

Moreover, logistical challenges, including port congestion and shipping delays, have exacerbated the situation. According to recent reports, the cost of shipping containers has skyrocketed, impacting the prices of imported goods. This increase in shipping costs is often passed down to consumers, further fueling inflation.

| Factor | Impact on Inflation |

|---|---|

| COVID-19 Pandemic | Factory shutdowns and labor shortages leading to product shortages |

| Logistical Challenges | Increased shipping costs due to port congestion |

| Geopolitical Tensions | Trade restrictions and tariffs increasing costs |

Additionally, geopolitical tensions play a crucial role in supply chain disruptions. Trade restrictions and tariffs can create uncertainty in the market, leading to increased costs for businesses that rely on imports. This uncertainty can deter investment and innovation, further compounding the inflationary pressures.

The impact of these disruptions is not uniform across all sectors. Some industries are more vulnerable to supply chain issues than others. For example, the food industry has faced significant challenges due to labor shortages and transportation delays, resulting in higher grocery prices. In contrast, sectors like technology may experience inflation due to component shortages, affecting product availability and pricing.

To mitigate these impacts, businesses are increasingly looking to diversify their supply chains and invest in local production. By reducing reliance on a single source or region, companies can better withstand future disruptions. Additionally, governments are exploring policies to enhance infrastructure and streamline logistics, which could alleviate some of the current pressures.

In conclusion, the impact of supply chain disruptions on inflation is profound and multifaceted. As businesses and consumers navigate these challenges, understanding the underlying causes can help in making informed decisions. By addressing the root issues and implementing strategic solutions, it may be possible to stabilize prices and restore confidence in the market.

Global Factors Influencing U.S. Inflation Rates

Inflation in the United States is increasingly influenced by a myriad of global factors. Understanding these external elements is crucial for comprehending the complexities of inflationary trends within the country. This section explores how international economic conditions, trade dynamics, and geopolitical events significantly impact U.S. inflation rates.

Global Economic Trends and Their Impact

The interconnectedness of global markets means that economic trends in one region can reverberate across the world. For instance, when major economies such as China or the European Union experience economic shifts, these changes can affect demand for U.S. exports and imports. A slowdown in these economies can lead to decreased demand for American goods, resulting in a surplus that may lower prices domestically. Conversely, if these economies are booming, demand for U.S. products may increase, driving prices higher.

Geopolitical Events and Inflationary Pressures

Geopolitical tensions, such as conflicts or trade disputes, can also exert significant pressure on inflation. For example, sanctions imposed on countries can disrupt supply chains and lead to shortages of critical goods, causing prices to rise. Additionally, instability in oil-producing regions can lead to fluctuations in oil prices, which have a direct impact on transportation costs and, consequently, consumer prices. The Russia-Ukraine conflict has, for instance, led to spikes in energy prices, contributing to higher inflation rates in the U.S.

Currency Fluctuations and Import Prices

The value of the U.S. dollar against other currencies plays a vital role in determining import prices. A strong dollar makes imports cheaper, which can help mitigate inflation. However, if the dollar weakens, imports become more expensive, leading to increased costs for consumers. This dynamic is particularly evident in the prices of goods like electronics, clothing, and raw materials, which are often sourced internationally.

Global Supply Chain Disruptions

Recent events, such as the COVID-19 pandemic, have highlighted the vulnerabilities in global supply chains. Disruptions can lead to shortages of essential goods, driving prices up. The chip shortage affecting the automotive and electronics industries is a prime example of how interconnected supply chains can lead to inflationary pressures in the U.S. economy.

International Trade Policies and Tariffs

Trade policies and tariffs imposed by the U.S. or other countries can also influence inflation. For instance, tariffs on imported goods can raise prices for consumers and businesses, contributing to inflation. The trade war with China led to increased costs for numerous products, impacting consumer prices across various sectors.

Conclusion

In summary, the factors influencing U.S. inflation are not solely domestic. Global economic trends, geopolitical events, currency fluctuations, supply chain disruptions, and trade policies all play critical roles in shaping inflationary pressures. Understanding these connections is essential for consumers and policymakers alike as they navigate the complexities of an increasingly interconnected world.

Inflation Predictions: What Experts Are Saying for the Future

Forecasting inflation is a complex task that requires a deep understanding of various economic indicators, consumer behavior, and global events. As we look ahead, experts are analyzing a myriad of factors that could influence future inflation trends. This section reviews their insights, predictions, and the underlying assumptions that drive their analyses.

One of the primary indicators that economists focus on is the Consumer Price Index (CPI), which measures the average change over time in the prices paid by consumers for goods and services. Recent trends in CPI have shown fluctuations, prompting experts to reevaluate their forecasts. Many analysts believe that inflation may stabilize in the coming years, but the path to that stability is fraught with uncertainty.

Another critical factor in predicting inflation is the labor market. With unemployment rates at historic lows, wage growth has been a significant driver of inflation. Experts argue that if wages continue to rise at a faster pace than productivity, we could see sustained inflationary pressures. Conversely, if the labor market cools, inflation rates may stabilize or even decline.

Global events also play a crucial role in shaping inflation predictions. For instance, ongoing geopolitical tensions and supply chain disruptions can lead to increased costs for raw materials and goods. Experts are closely monitoring these developments, as they can have a ripple effect on domestic prices. Additionally, the impact of monetary policy enacted by the Federal Reserve cannot be overlooked. Changes in interest rates can influence borrowing costs and consumer spending, ultimately affecting inflation.

Furthermore, consumer sentiment is an essential element in the inflation equation. If consumers expect prices to rise, they may alter their spending habits, which can create a self-fulfilling prophecy. Surveys indicate varying levels of consumer confidence, and these perceptions can significantly impact inflation trends.

| Factors Influencing Inflation Predictions | Potential Impact |

|---|---|

| Consumer Price Index (CPI) | Measures price changes; influences economic forecasts. |

| Labor Market Dynamics | Wage growth can lead to sustained inflation if productivity doesn’t keep pace. |

| Global Supply Chain Issues | Increased costs for goods can drive domestic inflation higher. |

| Monetary Policy Changes | Adjustments in interest rates can impact spending and inflation. |

| Consumer Sentiment | Expectations of future prices can influence current spending behavior. |

In summary, while experts provide various predictions regarding future inflation trends, the landscape remains unpredictable. Factors such as the labor market, global events, and consumer behavior will continue to play significant roles in shaping inflation rates. As we navigate these complexities, staying informed and adaptable will be crucial for consumers and businesses alike.

Strategies for Consumers to Combat Inflation

In today’s economic climate, where inflation continues to rise, consumers must adopt effective strategies to safeguard their finances. The effects of inflation can erode purchasing power, making it essential for individuals to take proactive measures. This section outlines practical tips for budgeting and saving in an inflationary environment, helping consumers navigate these challenging times.

- Review and Adjust Your Budget: Regularly revisiting your budget is crucial. With prices fluctuating, it’s important to identify areas where you can cut back. Focus on discretionary spending, such as dining out or entertainment, and allocate more funds to essential categories like groceries and utilities.

- Embrace Smart Shopping Habits: Take advantage of discounts, coupons, and cash-back offers. Consider buying in bulk for non-perishable items to save money in the long run. Additionally, comparing prices across different stores can help you find the best deals.

- Prioritize Savings: Establish an emergency fund that can cover at least three to six months’ worth of expenses. This fund will provide a safety net during uncertain times. Additionally, consider setting up automatic transfers to your savings account to ensure consistent saving habits.

- Invest Wisely: With inflation eroding cash value, consider investing in assets that typically outpace inflation, such as stocks, real estate, or commodities. Diversifying your investment portfolio can help mitigate risks and enhance potential returns.

- Utilize Inflation-Linked Savings Accounts: Some banks offer savings accounts or bonds that are indexed to inflation. These accounts can help maintain your purchasing power over time, making them a smart choice for long-term savings.

- Stay Informed About Economic Trends: Keeping abreast of inflation trends and economic forecasts can empower you to make informed financial decisions. Subscribe to financial news outlets or consult with a financial advisor to stay updated.

- Consider Side Hustles: Exploring additional income streams can bolster your financial situation. Whether it’s freelancing, tutoring, or selling handmade goods online, a side hustle can provide extra cash to offset rising costs.

By implementing these strategies, consumers can effectively combat the effects of inflation and maintain their financial stability. It’s essential to remain adaptable and proactive in managing your finances in an ever-changing economic landscape. Remember, the key to thriving during inflationary periods lies in informed decision-making and strategic planning.

Inflation and Interest Rates: Understanding the Connection

Inflation and interest rates are two fundamental components of the economic landscape that are closely interconnected. Understanding the relationship between these two elements is crucial for borrowers, investors, and policymakers alike. In this section, we will explore how rising inflation can lead to changes in interest rates and the implications for various stakeholders.

What Is Inflation and How Does It Affect Interest Rates?

Inflation refers to the increase in prices of goods and services over time, which diminishes the purchasing power of money. When inflation rises, it often prompts central banks, like the Federal Reserve in the United States, to adjust interest rates to stabilize the economy. Higher inflation typically leads to higher interest rates as lenders seek to maintain their profit margins and compensate for the decreased purchasing power of future repayments.

Mechanisms of Interest Rate Adjustments

When inflation is on the rise, central banks may implement a series of monetary policies aimed at curbing inflationary pressures. This includes increasing the federal funds rate, which is the interest rate at which banks lend to one another overnight. As this rate increases, borrowing costs for consumers and businesses also rise, leading to a potential slowdown in economic activity.

Implications for Borrowers

- Higher Loan Costs: For borrowers, rising interest rates mean higher costs for mortgages, personal loans, and credit cards. This can significantly impact household budgets and spending.

- Refinancing Challenges: Homeowners looking to refinance their mortgages may find it less advantageous as rates increase, potentially locking them into higher payments.

- Investment Decisions: Businesses may delay or reconsider expansion plans due to increased borrowing costs, which can affect job creation and economic growth.

The Broader Economic Impact

As interest rates rise in response to inflation, the overall economic environment can shift. Higher rates can lead to reduced consumer spending and investment, which may slow down economic growth. Conversely, if inflation is kept in check, lower interest rates can stimulate spending and investment, fostering economic growth.

Global Influences on Inflation and Interest Rates

It is essential to recognize that inflation and interest rates are not solely influenced by domestic factors. Global events, such as supply chain disruptions, geopolitical tensions, and international trade policies, can also affect inflation rates. For example, an increase in oil prices due to geopolitical instability can lead to higher transportation costs, contributing to inflationary pressures in the U.S. This, in turn, may prompt the Federal Reserve to adjust interest rates accordingly.

Conclusion: Navigating the Economic Landscape

Understanding the connection between inflation and interest rates is vital for making informed financial decisions. As inflation rises, it is crucial for borrowers to be aware of the potential impact on their finances and to consider strategies to mitigate the effects of higher interest rates. Whether through budgeting, refinancing options, or investment strategies, being proactive can help consumers navigate the complexities of an inflationary environment.

Government Policies Addressing Inflation: An Analysis

Inflation has emerged as a pressing concern for economies worldwide, particularly in the United States. In response, the government has implemented a range of policies aimed at stabilizing prices and curbing inflationary pressures. This section provides an in-depth analysis of these interventions, examining their effectiveness and the broader economic implications.

One of the primary tools used by the government is monetary policy. The Federal Reserve, as the central bank, adjusts interest rates to influence economic activity. When inflation rises, the Fed may opt to increase interest rates, making borrowing more expensive and encouraging saving rather than spending. This tactic aims to cool off demand in the economy, which can, in turn, help to stabilize prices. Recent adjustments have seen rates rise significantly, reflecting the Fed’s commitment to controlling inflation.

Another critical area of intervention is fiscal policy. The government can alter spending and taxation levels to influence economic conditions. For instance, during periods of high inflation, reducing government spending can help decrease overall demand in the economy. Conversely, targeted fiscal measures, such as subsidies for essential goods, can alleviate the burden on consumers facing rising prices. However, the effectiveness of such measures often depends on the political landscape and public acceptance.

Moreover, regulatory measures play a vital role in addressing inflation. The government can impose price controls on essential commodities to prevent exorbitant price hikes. While these measures may provide short-term relief, they can lead to unintended consequences, such as shortages and reduced supply. Therefore, careful consideration is necessary to balance immediate consumer needs with long-term market health.

Additionally, the global economic environment significantly impacts domestic inflation. Supply chain disruptions, geopolitical tensions, and fluctuating commodity prices can all contribute to rising costs. The government must navigate these external factors while implementing policies that stabilize the economy. Collaborative efforts with international partners can enhance resilience against global inflationary pressures.

In evaluating the effectiveness of these interventions, it is crucial to consider data and expert analyses. Recent studies suggest that while monetary policy adjustments have had some success in tempering inflation, the lagging effects of such measures mean that consumers may continue to feel the impact of rising prices for some time. Additionally, fiscal measures can provide immediate relief, but their long-term sustainability remains a concern.

In conclusion, government policies addressing inflation are multifaceted and require a careful balance of monetary, fiscal, and regulatory strategies. While recent interventions have shown promise in stabilizing prices, ongoing analysis and adjustments will be necessary to navigate the complexities of an ever-evolving economic landscape.

The Psychological Effects of Inflation on Consumers

Inflation is not merely an economic phenomenon; it profoundly affects the psychological state of consumers. As prices rise, many individuals experience feelings of anxiety and uncertainty, which can lead to significant changes in behavior and spending habits. This section delves into the psychological effects of inflation, exploring how it shapes consumer confidence and influences their financial decisions.

As inflation escalates, consumers often become increasingly anxious about their financial futures. This anxiety stems from the fear of losing purchasing power and the potential inability to afford essential goods and services. According to recent studies, 72% of consumers report heightened stress related to rising prices. This psychological burden can lead to a cycle of reduced spending, further impacting the economy.

Inflation can significantly undermine consumer confidence. When individuals perceive that prices are consistently rising, they may hesitate to make significant purchases, fearing that their financial situation may worsen. This hesitation can lead to a decrease in overall consumer spending, which is vital for economic growth. Research indicates that a 10% increase in inflation can correlate with a 15% drop in consumer confidence, demonstrating the delicate balance between economic indicators and psychological responses.

As inflation affects consumers’ psychological states, their spending habits also evolve. Many consumers may prioritize essential goods while cutting back on non-essential purchases. For instance, a survey revealed that 65% of respondents have altered their shopping behaviors, opting for generic brands or discount retailers to manage their budgets. This shift can have long-term implications for brand loyalty and market dynamics.

The media plays a crucial role in shaping public perceptions of inflation. Constant coverage of rising prices can amplify feelings of anxiety and uncertainty. Consumers often rely on news outlets for information, and sensationalized reporting can lead to panic buying or hoarding behaviors. A study found that 40% of consumers admitted to changing their purchasing habits based on media reports about inflation, illustrating the power of information in influencing consumer psychology.

To combat the anxiety induced by inflation, consumers can adopt several strategies.

- Budgeting: Creating a detailed budget can help individuals regain control over their finances.

- Education: Understanding inflation and its causes can demystify the phenomenon, reducing fear.

- Mindfulness: Practicing mindfulness techniques can alleviate stress and promote a healthier mental state.

By implementing these strategies, consumers can mitigate the psychological impacts of inflation, fostering a more stable financial outlook.

In summary, the psychological effects of inflation on consumers are profound and multifaceted. As anxiety and uncertainty grow, consumer confidence and spending behaviors shift, leading to broader economic implications. Understanding these dynamics is essential for both consumers and policymakers to navigate the challenges posed by inflation effectively.

Frequently Asked Questions

- What is inflation and why is it important?

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It’s crucial because it affects everything from your grocery bill to interest rates on loans.

- How are inflation rates determined?

Inflation rates are determined by various factors, including consumer demand, production costs, and monetary policy set by the Federal Reserve. Essentially, it’s a complex dance between supply and demand in the economy.

- How does inflation impact consumer spending?

When inflation rises, consumers often become more cautious with their spending. They may prioritize essential items over luxury purchases, which can affect overall economic growth.

- What role does the Federal Reserve play in controlling inflation?

The Federal Reserve manages inflation through monetary policy, adjusting interest rates and influencing money supply to stabilize the economy. Think of it as the economy’s thermostat, trying to keep everything at a comfortable temperature.

- Can inflation affect interest rates?

Absolutely! Generally, when inflation goes up, interest rates tend to follow suit. This means borrowing costs can increase, impacting loans and mortgages for consumers.

- What strategies can consumers use to combat inflation?

Consumers can combat inflation by budgeting wisely, looking for discounts, and considering investments that outpace inflation. It’s like preparing for a storm—you want to be ready when the winds pick up!