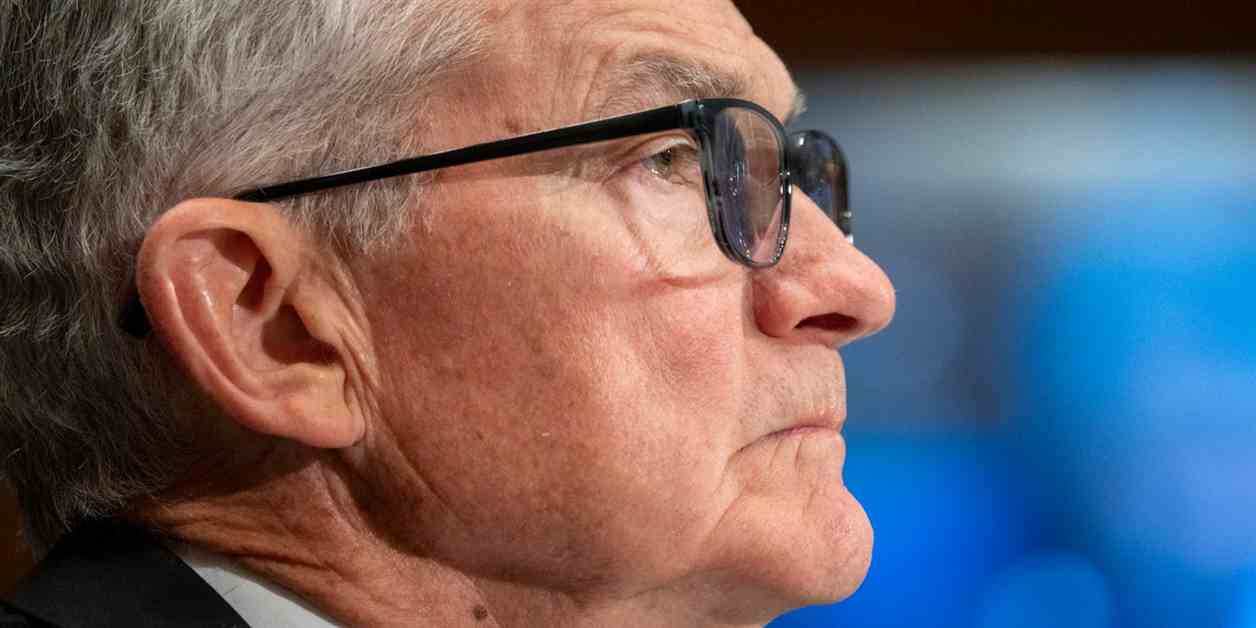

The Federal Reserve concluded its two-day meeting with no interest rate cut in sight, disappointing those hoping for a decrease. Analysts predict that the Fed’s benchmark interest rate will likely remain between 5.25% to 5.5%, where it has stood for nearly a year. Despite initial expectations of multiple rate cuts in 2024, persistent inflation has prevented the Fed from making any changes. The market will closely watch Fed chair Jerome Powell’s press conference for any hints on future rate actions.

While inflation remains a concern, recent data shows that the U.S. economy is still growing, albeit at a slower pace. The unemployment rate in May rose to 4%, indicating a potential slowdown in hiring. Additionally, the economy produced $22.7 trillion worth of goods in the first quarter of 2024, contributing to a 1.3% GDP growth.

Inflation continues to linger above the Fed’s 2% target, with the annual rate hovering around 3% to 3.5%. Factors such as high rent prices and strong wage growth are contributing to this elevated inflation. The Fed remains cautious about cutting interest rates until there is clearer progress towards reaching their inflation target.

Despite the lack of a rate cut in this meeting, the Fed has several more opportunities throughout the year to adjust interest rates. The stock market reacted positively to the news of stable inflation, with major indices reaching record highs. While a rate cut may not be imminent, analysts are closely monitoring inflation data for potential future actions by the Federal Reserve.

Overall, the Fed’s decision to keep interest rates steady reflects the ongoing challenge of managing inflation while supporting economic growth. As the year progresses, market conditions and inflation trends will continue to influence the Fed’s monetary policy decisions.