Bitcoin’s Future Price Predictions and MicroStrategy’s Potential Growth

According to a recent report, the price of bitcoin is expected to soar to $1 million by 2033 and reach a cycle-high of $200,000 by 2025. This optimistic forecast has been made by Bernstein, a reputable financial firm that recently initiated coverage on MicroStrategy, a software developer known for being the largest corporate owner of bitcoin.

MicroStrategy, based in Tysons Corner, Virginia, has been making waves in the cryptocurrency world by holding 1.1% of the global supply of bitcoin, valued at approximately $14.5 billion. In just four years, the company has transformed itself from a small software firm into a major player in the crypto market. Bernstein has set an outperform rating for MicroStrategy with a price target of $2,890, significantly higher than the current trading price of around $1,484.

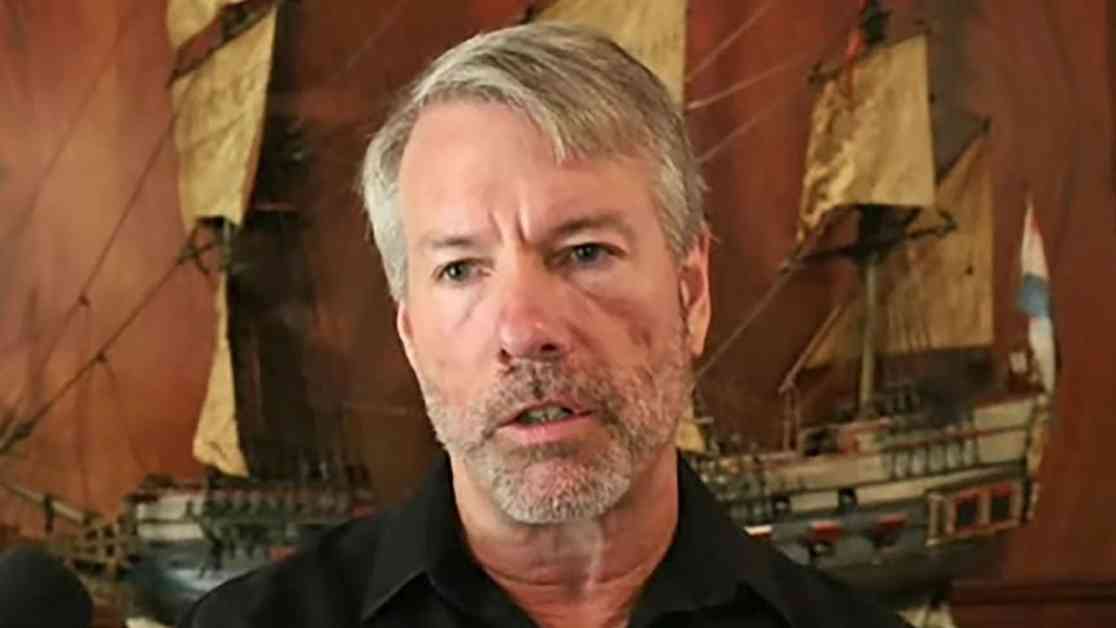

The company’s founder and chairman, Michael Saylor, has been instrumental in positioning MicroStrategy as a key player in the bitcoin space. By adopting the cryptocurrency as a reserve asset and actively acquiring bitcoin since 2020, MicroStrategy has differentiated itself from other companies by implementing an aggressive bitcoin acquisition strategy.

Unlike passive spot exchange-traded funds (ETFs), MicroStrategy has taken an active leveraged approach to its bitcoin strategy, resulting in higher bitcoin per equity share over the past four years. This proactive stance has attracted significant capital in the form of debt and equity, allowing the company to expand its bitcoin holdings and potentially benefit from the cryptocurrency’s future growth.

Bernstein’s bullish bitcoin price forecast is based on the increasing demand from spot ETFs and the limited supply of the cryptocurrency. The firm now projects that bitcoin could reach $500,000 by 2029, with the 2025 estimate being raised from $150,000 to $200,000. This positive outlook reflects the growing confidence in bitcoin as a viable investment asset.

MicroStrategy’s long-term convertible debt strategy has been highlighted as a key factor in mitigating liquidation risks associated with holding bitcoin on its balance sheet. By proposing a $500 million debt sale of convertible notes to fund further bitcoin acquisitions, the company aims to capitalize on potential upside while managing potential downside risks.

In conclusion, the future looks bright for both bitcoin and MicroStrategy, with the cryptocurrency expected to reach new price milestones in the coming years. As MicroStrategy continues to position itself as a leading bitcoin company, investors and analysts are optimistic about the company’s growth potential and its ability to capitalize on the evolving cryptocurrency market.

By staying ahead of the curve and actively engaging with the crypto industry, MicroStrategy is well-positioned to benefit from the digital currency revolution and potentially achieve significant returns for its stakeholders. As the world of finance continues to embrace bitcoin and other digital assets, companies like MicroStrategy are paving the way for a new era of investment opportunities and financial innovation.