Weekly Market Outlook (27-31 May) | Forexlive

The upcoming week is filled with important economic events that are expected to impact the global markets. From key data releases to central bank announcements, here’s what investors need to watch out for:

**Monday**: The UK and US markets will be closed for holidays, while Germany will release its IFO business climate index.

**Tuesday**: Australia will release its Retail Sales data, Canada will announce its Producer Price Index (PPI), and the US will publish its Consumer Confidence figures.

**Wednesday**: Australia’s Monthly Consumer Price Index (CPI) will be in focus, along with the release of the Federal Reserve’s Beige Book.

**Thursday**: Switzerland will release its GDP data, the Eurozone will announce its Unemployment Rate, and the US will publish its 2nd Estimate of GDP and Jobless Claims.

**Friday**: Japan will release its Tokyo Consumer Price Index (CPI), Retail Sales, and Industrial Production data, China will publish its Purchasing Managers’ Index (PMI), Switzerland will release its Retail Sales and Manufacturing PMI data, the Eurozone will announce its Flash CPI, Canada will release its GDP data, and the US will publish its Personal Consumption Expenditures (PCE) data.

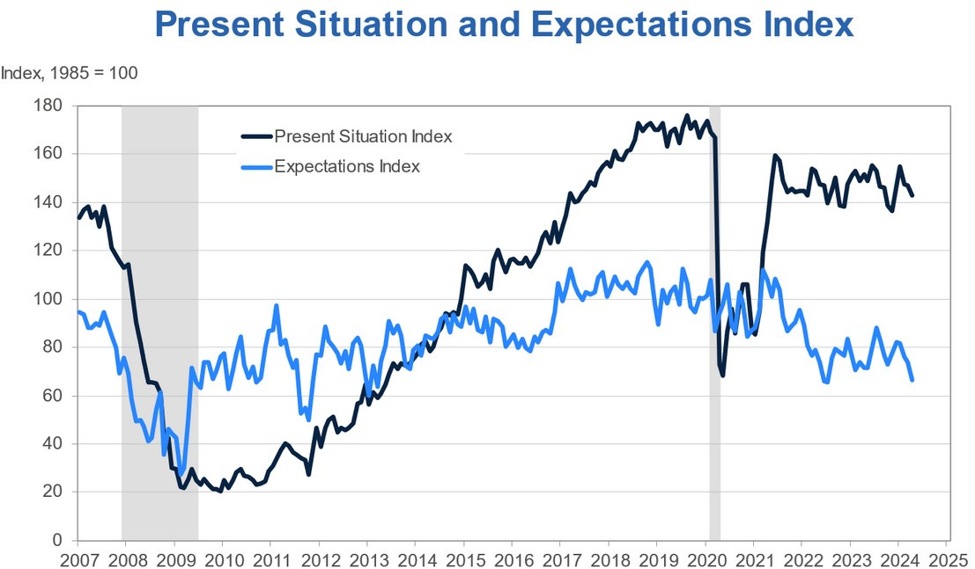

**US Consumer Confidence**: The US Consumer Confidence is expected to decrease in May, reflecting concerns about the future business conditions and job availability.

**Australian Monthly CPI**: The Australian Monthly CPI Year-over-Year (YoY) is expected to show a slight decrease, which may not have a significant impact on the central bank’s monetary policy decisions.

**Eurozone Unemployment Rate**: The Eurozone Unemployment Rate is expected to remain unchanged, indicating a tight labor market and potentially influencing the European Central Bank’s rate cut decisions.

**US Jobless Claims**: The US Jobless Claims data will provide insights into the state of the labor market, with low initial claims suggesting a strong job market.

**Tokyo Core CPI**: The Tokyo Core CPI is expected to show a slight increase, but overall inflation in Japan remains subdued.

**Chinese Manufacturing PMI**: The Chinese Manufacturing PMI will be closely watched for signs of economic recovery, with weak data potentially prompting further policy easing by the People’s Bank of China.

**Eurozone Core CPI**: The Eurozone Core CPI data will impact market expectations for future rate cuts, especially if inflation remains strong.

**US Headline PCE**: The US Headline Personal Consumption Expenditures data is expected to show a slight decrease, but it is unlikely to change the Federal Reserve’s current stance on interest rates.

Overall, the upcoming week is packed with key economic events that could shape market sentiment and investment decisions. Investors will be closely monitoring the data releases and central bank announcements for any signs of economic growth or potential policy changes.