Is It Too Late to Buy Chubb Limited Stock?

Investing great Warren Buffett scooped up a new position for Berkshire Hathaway’s famous stock portfolio in Q1. The Oracle of Omaha added approximately $6 billion of Chubb Limited (NYSE: CB). Considering Buffett’s massive existing insurance operations via GEICO, the insurance company is an interesting addition.

Chubb’s stock performance has been anything but boring. Shares are up an impressive 36% over the past year, and news of Buffett’s buy only fueled bullish sentiment toward the stock. So can investors still get in on Chubb? Or has the ship sailed?

Here is what you need to know.

Buffett picks up another insurance business

Chubb is an insurance company that provides products to over 50 countries worldwide. Its products include commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance, and life insurance. There is some overlap with GEICO, which Berkshire owns privately. For example, both companies offer auto insurance, which is GEICO’s claim-to-fame.

However, there are some crucial differences between the two. GEICO is a mainstream insurer; it’s widely available and offers a quick price and coverage access. Its motto for years has been “15 minutes can save you 15% or more on car insurance.”

Chubb’s business model emphasizes more personalized customer relationships via a network of independent agents. It offers coverage options that are difficult to find with other insurers. It’s arguably the opposite angle of GEICO’s price-first marketing approach. Therefore, you could imagine Chubb appealing to a customer base that is different from GEICO’s, so one could see why Buffett felt it was appropriate to invest in the business despite GEICO’s presence.

Buffett invested? You know the fundamentals are clean

Speculative companies are not Warren Buffett’s preferred style. It shouldn’t surprise you that Chubb is a fundamentally clean company with a long track record of success. The company has paid and raised its dividends for over three decades, a common characteristic of “Buffett stocks.”

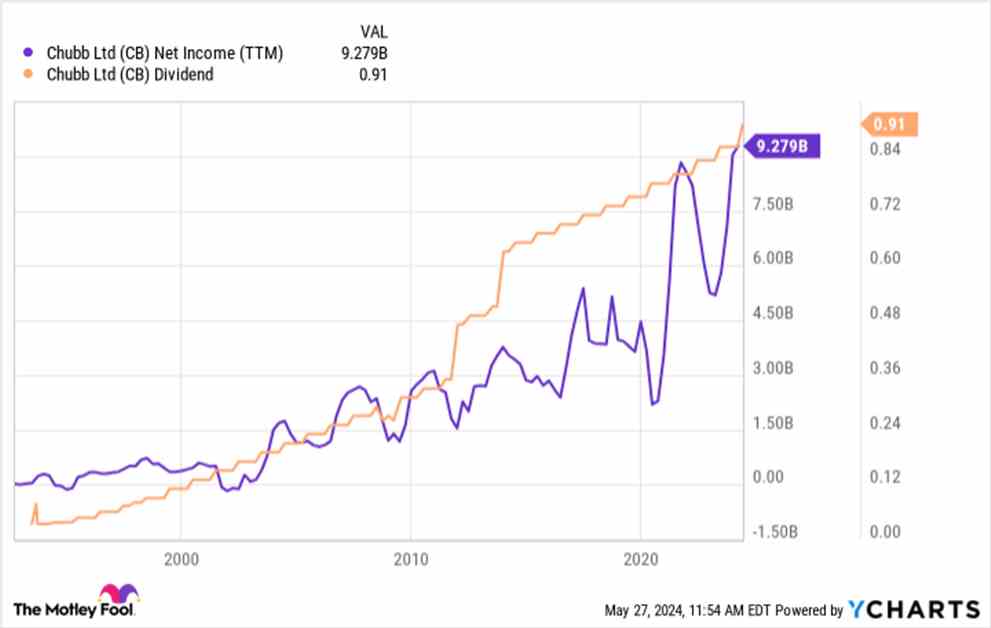

Below, you can see that Chubb’s profits have climbed ever higher over time. Yes, the business suffers the occasional setback (what company doesn’t?), but the dividend has remained stable for two reasons. First, the payout represents just 15% of net income. That means even a sizable profit drop doesn’t threaten Chubb’s ability to pay shareholders. The other ingredient is a clean balance sheet. Chubb carries a stellar AA rating from Standard & Poor’s.

Steady growth with clean financials can be a potent formula for investment returns. The stock has outperformed the S&P 500 by more than two to one since the early 1990s, and Buffett’s investment of billions of dollars seems to confirm his belief that this trend will continue.

So what should investors do today? Insurance companies enjoy high interest rates because they invest the premiums to generate income. Chubb’s net income has surged, and the stock has commanded a higher valuation since the FOMC began raising rates a couple of years ago.

While the stock is trading above its average price-to-book value ratio today, that didn’t deter Buffett from buying shares. Chubb’s business could continue to do well if rates remain “higher for longer” due to stubbornly high inflation.

But now, with a valuation near decade highs, it’s unclear how much more short-term upside the stock may have. Interested investors may consider buying a little at a time to leave some dry powder if the stock offers a better buying opportunity later.

Before you buy stock in Chubb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chubb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.