Nvidia Announces 10-for-1 Stock Split and Begins Trading

Nvidia stock (NVDA) started trading on Monday following a 10-for-1 split, reducing the Friday closing price of $1,208.88 to $120.88. The stock saw a slight increase of less than 1% on Monday afternoon.

The split allowed shareholders of Nvidia common stock as of Thursday’s market close to receive 10 shares for each share they held. For example, if a shareholder owned four shares of Nvidia before the split, they now own 40 shares.

Stock splits like this make owning shares more affordable by reducing the price of individual shares without affecting the total value of existing shareholders’ holdings.

The split comes after Nvidia briefly surpassed a $3 trillion market valuation, making it the second-most valuable publicly traded US company, surpassing Apple. The company’s shares have seen a significant increase due to the rising interest in generative AI, particularly after the launch of OpenAI’s ChatGPT software in late 2022.

Nvidia’s revenue has soared, with the company reporting a substantial increase in earnings per share and revenue compared to the previous year. The Data Center revenue in the latest quarter was up 427% year over year to $22.6 billion, accounting for 86% of the total revenue.

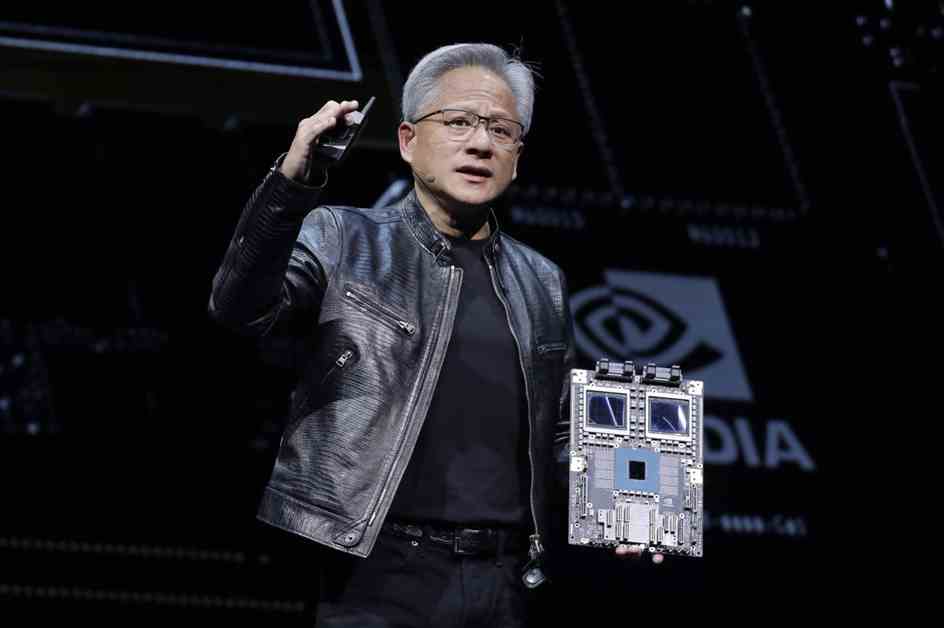

CEO Jensen Huang announced plans for new hardware platforms, including an upgraded version of Blackwell AI, called Blackwell Ultra, set for release in 2025, as well as a new platform called Rubin in 2026. Additionally, an Ultra version of the Rubin hardware is expected in 2027.

Stock splits are generally viewed positively by investors and are often seen as a sign of strength. Companies that split their stock typically outperform the S&P 500 in the year following the split announcement.

Nvidia’s split announcement has led to a 27% increase in its stock price since May. Competitors like AMD and Intel are also making advancements in AI hardware, while Nvidia’s customers are exploring alternative options to mitigate costs.

Beyond tech companies, Nvidia sees a growing market in government organizations, research institutions, and other sectors, suggesting potential for further growth.

For more tech news and analysis, subscribe to the Yahoo Finance Tech newsletter and follow reporters Daniel Howley and Josh Schafer for updates.