GigaCloud Technology Stock Is Up 470% in the Past Year. Time to Buy or Stay Away?

One of the hottest stocks on Wall Street has been GigaCloud Technology (NASDAQ: GCT), which saw a staggering 470% increase in value over the past year. Despite this remarkable growth, the company has come under intense scrutiny from investors due to a number of red flags that have been raised by short-sellers.

Investor interest in GigaCloud’s stock stems primarily from the company’s impressive revenue growth. In 2023, GigaCloud saw a 44% increase in revenue to $704 million, with net income surging nearly 300% to $94 million and adjusted EBITDA nearly tripling to $118 million. The first quarter of 2024 has been even more promising, with revenue soaring by nearly 97% to $251 million.

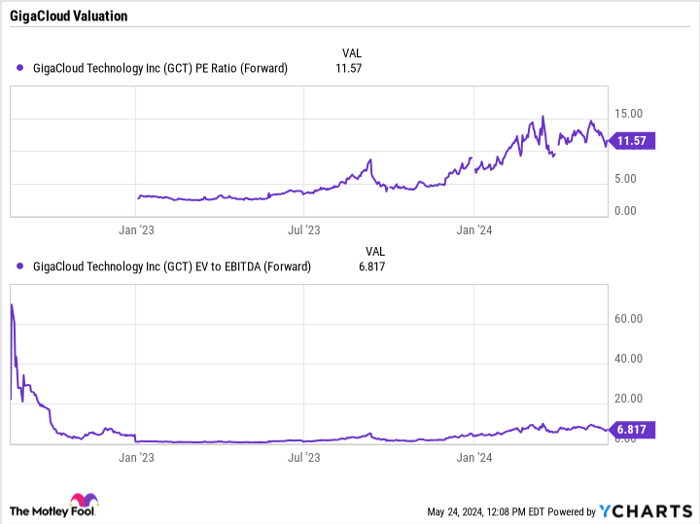

Despite its rapid growth, GigaCloud’s stock remains attractively priced, trading at just 11.6x on a forward price-to-earnings (P/E) basis and under 7x on an enterprise value (EV)-to-EBITDA basis. However, the company’s success has raised concerns among investors, particularly regarding its core business model.

GigaCloud, despite its name, operates as an online retailer of inexpensive Chinese furniture, with a significant portion of its revenue coming from product sales. This has raised questions about the sustainability of its growth, especially considering the challenges faced by the broader furniture industry. Short-sellers have also raised doubts about the company’s operations, with reports questioning the accuracy of GigaCloud’s reported metrics.

Given these red flags, it may be prudent for investors to exercise caution when considering GigaCloud stock. While the company’s growth potential is undeniable, the controversies surrounding its business practices and industry trends raise significant concerns. As such, there may be more promising investment opportunities available in the market.

Before making any investment decisions, it is advisable to conduct thorough research and consider all available information. The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy now, and GigaCloud Technology is not among them. It may be wise to explore alternative investment options with less controversy and greater potential for long-term success.

In conclusion, while GigaCloud Technology has shown impressive growth in recent years, the company’s underlying business model and industry dynamics raise significant questions about its future prospects. Investors should proceed with caution and consider all available information before making any investment decisions.