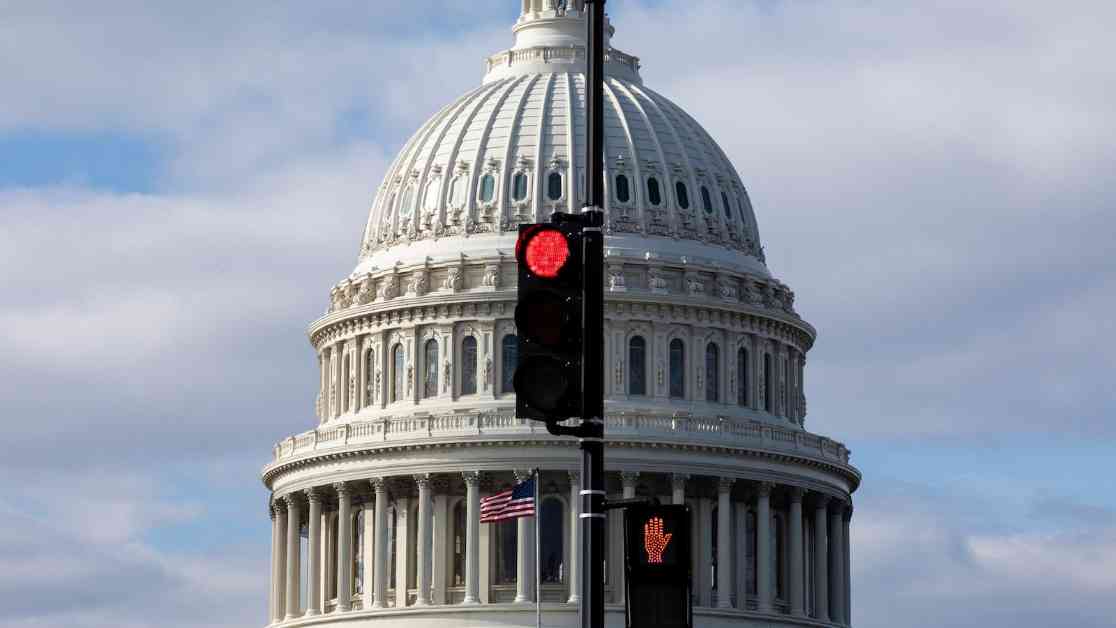

Understanding the Debt Ceiling: Trump’s Claims on Default Explained

In a recent turn of events, President-elect Donald Trump has brought the debt ceiling into the spotlight by rejecting a bipartisan government funding deal and demanding lawmakers raise the debt ceiling as they fund the government. Trump’s stance raises questions about the potential consequences of a U.S. government default on its bills.

What is the debt ceiling?

The debt ceiling is a cap on the amount of money the U.S. government can borrow to pay its debts. As the government spends more than it generates from taxes, it needs to borrow money to cover the deficit. However, the debt ceiling sets a limit on how much the government can borrow, creating a financial restriction.

Possible Consequences of Default

If the U.S. government fails to pay its bills due to the debt ceiling, there could be dire consequences for millions of people. These include seniors missing Social Security payments, increased interest rates affecting mortgages and credit card payments, market instability impacting investments, disruptions in military and veteran payments, delays in FEMA funding for disaster relief, and halts in essential food assistance programs.

The economic fallout from a protracted breach of the debt ceiling could mirror the 2008 financial crisis, leading to massive job losses, stock market declines, and significant household debt reduction. This scenario could have devastating effects on the economy and people’s livelihoods.

Debt Ceiling vs. Government Shutdown

While a government shutdown disrupts new payments for federal employees, a default on the debt would have far-reaching implications. The U.S. has never defaulted on its debt, and such an unprecedented event would destabilize financial markets, increase interest rates, and disrupt the entire economic system. Unlike a shutdown, a default could lead to missed payments across all government spending, mandatory payments, debt interest, and bondholder payments.

The stakes are high, and the potential repercussions of a U.S. government default are severe. As Congress navigates this critical issue, the importance of raising the debt ceiling to avoid economic catastrophe cannot be overstated.